At retirement age

The 1st pillar is intended to cover basic needs in retirement.

Currently, the minimum old-age pension for a single person is CHF 1,225.- per month, and the maximum pension, CHF 2,450.-.

The amount of your pension depends on several factors, in particular:

The number of years you have paid OASI contributions: if you have paid OASI contributions throughout your working life, you are entitled to a full pension. If you have missed contributions, you will receive a reduced pension. For example: failure to pay OASI contributions for one year will reduce your pension by around 2.3%.

The higher your salary, the higher your OASI contributions. This will increase your pension. To get a maximum pension, your average annual income will need to be at least around CHF 88,200.-.

Please note: the pension for married couples and couples in a registered partnership is limited to 150% of a maximum single pension, currently CHF 3,675.- (even if the sum of the spouses’ or partners’ two pensions exceeds this amount).

With early or postponed retirement

The statutory retirement age in Switzerland is 65. It is possible to retire early by one or two years, in which case you will receive a reduced pension.

If you retire a year early, your pension will be reduced by 6.8%, and by 13.6% if you retire two years early.

If, on the other hand, you decide to postpone your retirement by one or, at most, five years, your pension will increase depending on how much longer you work beyond retirement.

OASI pension estimate

You may, at any time, request an estimate of the pension you will receive when you retire.

Please note: this estimate is only indicative, since it is based on the legal provisions in force and on the contributions you have made up until that point.

Supplementary benefits

If your OASI pension does not cover your basic living expenses, you are entitled to supplementary benefits.

Medical and support equipment provided by OASI

OASI recipients are can also receive medical and support equipment (web page available in German, French and Italian), such as walking aids, glasses, prostheses or lifts.

At retirement age

The 2nd pillar pension is calculated on the basis of the contributions you made during your working life and according to the regulations of the pension fund you paid into.

At retirement age, you generally receive a monthly retirement pension based on the amount you have accumulated.

The different pension funds provide options including paying out ¼ or more of your 2nd pillar in the form of a lump sum (one-off payment) and the rest in the form of a monthly pension, or the entire lump sum payment instead of a pension.

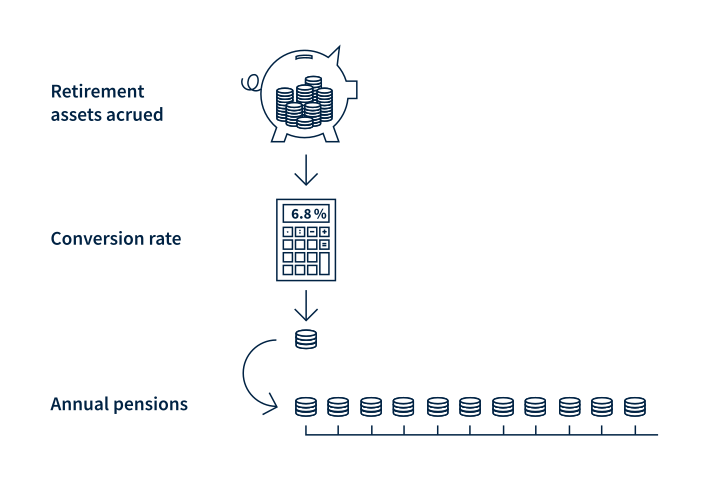

The retirement pension is calculated on the basis of a conversion rate (web page available in German, French and Italian). The conversion rate is applied to the accumulated capital in your 2nd pillar account to determine the annuity you will receive for the rest of your life. The minimum conversion rate is currently set by law at 6.8 per cent.

Example:

If you accumulate CHF 200,000 in your 2nd pillar account during your working life and the conversion rate is 6.8 per cent, the annuity amounts to CHF 13,600 a year, or CHF 1,133 a month.

To find out how much capital you have accumulated in your 2nd pillar, the payout options and what pension you are entitled to, contact your pension fund.

The occupational pension in the event of early or postponed retirement

Depending on your pension fund’s regulations, you can receive your 2nd pillar pension early (at 58 at the earliest) or postpone it (to 70 at the latest).

If you retire early, your pension will be reduced. If you postpone your retirement, the conversion rate of your pension will increase and so will your pension.

Contact your pension fund for more specific information about your pension.

By making non-compulsory contributions to a 3rd pillar account, your increase your total retirement savings .

In general, you can withdraw your 3rd pillar savings in one go (at the earliest, five years before the statutory retirement age and up to five years after the statutory retirement age if you can prove that you are still working).

Contact the financial institution where you have your 3rd pillar account to find out how much capital you have accumulated, your options for withdrawal and the amount of your savings if you decide to retire early or to postpone your retirement.

You must declare all your monthly pensions (OASI 1st pillar pension, occupational 2nd pillar pension and 3rd pillar savings) to the tax authorities. These pensions are taxed as income.

Lump sum payouts from the 2nd and 3rd pillars are taxed at a special rate.

Supplementary benefits for OASI and invalidity are not taxed.

Tax statements for retirement pensions

At the end of each year, the institutions that manage your pension accounts will send you tax statements for your 1st, 2nd and 3rd pillar pensions. This will give you some time to complete your tax return.

You can request a pension statement at any time of the year from your cantonal compensation office or your pension fund.

For more information about your OASI pension, contact your cantonal compensation office.

The social insurance brochure provides detailed information about flexible retirement ages and the financial consequences of early or postponed retirement.

This page on supplementary benefits also provides useful information.