Importing goods into Switzerland

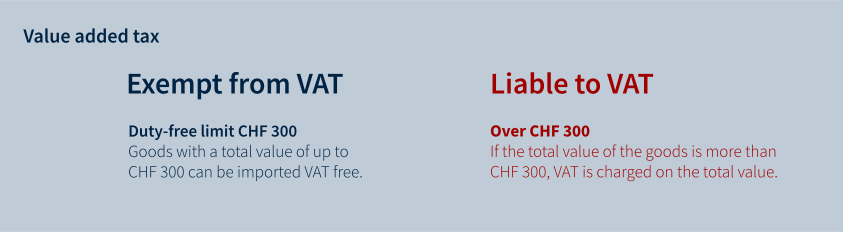

Goods can be imported into Switzerland free of charge if their total value does not exceed CHF 300. If the total value of goods is more than CHF 300, you will be charged Swiss VAT on the total value.

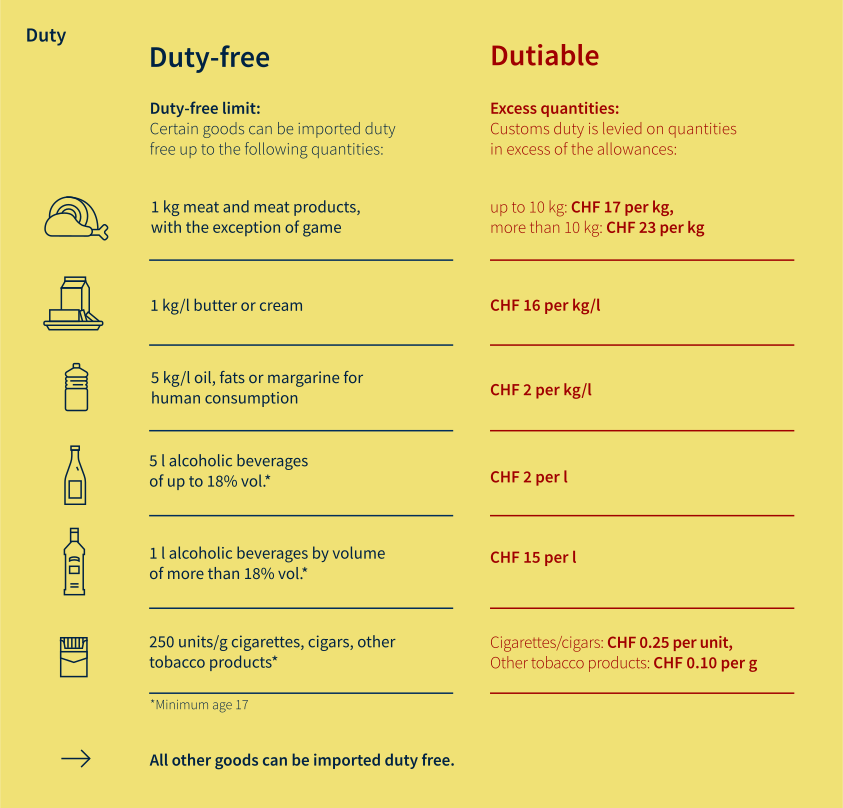

There is also a limit on the quantity of foodstuffs, alcohol and tobacco that can be imported. If you exceed the limit, you will be charged customs duties.

Examples of quantities allowed into Switzerland free of charge for:

Alcoholic beverages with an alcohol content of <18%: 5 litres per person per day

Alcoholic beverages with an alcohol content of >18%: 1 litre per person per day

Meat: 1kg per person per day

Cigarettes: 250 cigarettes per person per day

If you bring goods purchased abroad to Switzerland, you often have the option of claiming a refund of foreign VAT.

Transit of goods through Switzerland

Anyone travelling through Switzerland with personal goods must declare these goods when entering Switzerland. Any customs duties payable will be reimbursed to you (in Swiss francs) when you leave Switzerland.

If you are simply leaving Switzerland with personal goods, you do not need to complete any special customs export formalities. But don’t forget to check the import rules of your destination country.

Customs fees vary depending on the goods. For foodstuffs, alcohol and tobacco, fees depend on how much the imported quantities exceed allowances.

Importation into Switzerland

The following information applies per person per day for goods that you import for private use or as a gift.

QuickZoll App

QuickZoll is an app provided by the Federal Office for Customs and Border Security for the importation of personal goods. The app allows you to declare your goods before you bring them into the country and to pay any customs fees directly. The goods cleared for import using QuickZoll can then be brought into Switzerland at any border crossing.

You can download the QuickZoll app to your mobile phone free of charge and do not need to register to use it.

Verbal customs declaration

If there are customs officials stationed at the Swiss border crossing, you need to spontaneously declare the goods you are carrying. In airports choose the red exit to declare your goods.

If you are travelling by rail, you can make a verbal declaration to a customs official on the train. If there are no customs officials on the train, you can declare your goods at any customs office during business hours within seven days of your arrival in Switzerland.

Written self-declaration

If you enter the country at an unmanned border crossing, you can fill out a self-declaration form. These forms are available in the declaration box. However, this option is not available for declaring goods that are to be sold or traded.

If you bring goods purchased abroad to Switzerland, you often have the option of having the foreign VAT refunded. The Federal Office for Customs and Border Security is not authorised to make this refund and is unable to provide any information on how to proceed.

Foreign VAT refunds are made by the seller abroad or by a VAT refund company. Different rules apply to VAT refunds in different countries. Sellers abroad generally provide you with a refund form on which the foreign customs authority can confirm the exportation of your purchase to Switzerland.

Swiss VAT must be paid on goods of a total value exceeding CHF 300 on import even if the foreign VAT is not refunded.

The illustrated brochure Customs info: essential information at a glance provides basic information for individuals.

The Federal Office for Customs and Border Security provides detailed information on importation into Switzerland, allowances and duty-free limits.

For more information about customs declarations when you travel into Switzerland by train, click here.

When planning your trip to Switzerland, check the addresses and business hours of border crossings and customs offices beforehand.

For information on ordering goods abroad online, have a look at the ch.ch page on ordering goods abroad.